|

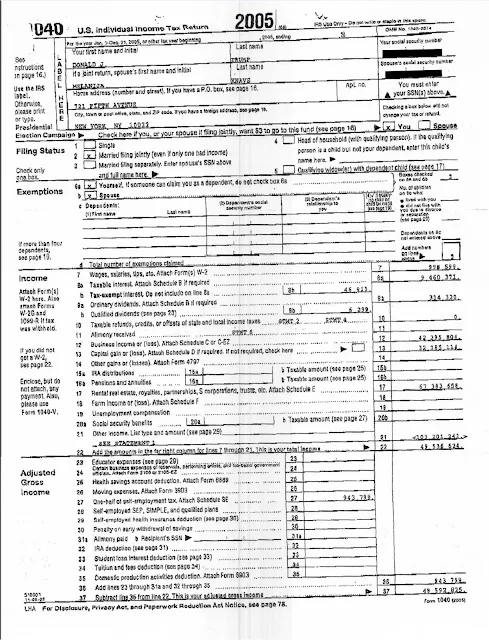

| President Donald Trump's Tax return of 2005 |

VietPress USA (April 13, 2019): Today on Saturday, April 13, 2019, Chairman Richard Neal of the House Ways and Means Committee sent the second letter to the Internal Revenue Service (IRS) to give the deadline on April 23, 2019 for IRS to hand over President Trump's personal and business tax returns for 6 years from 2013 to 2018.

Chairman Richard Neal sent a letter earlier this month to IRS Commissioner Charles Rettig asking that the returns be turned over by April 10. Treasury Secretary Steven Mnuchin responded by the deadline saying he needed more time to review the request and consult with the Department of Justice.

Citing an “unambiguous legal obligation,” Richard Neal said a section of the tax code that allows the chairman of the tax committees to request the returns of any taxpayer, including the president.

“Please know that, if you fail to comply, your failure will be interpreted as a denial of my request,” Neal wrote.

Neal sent a letter earlier this month to IRS Commissioner Charles Rettig asking that the returns be turned over by April 10. Treasury Secretary Steven Mnuchin responded by the deadline saying he needed more time to review the request and consult with the Department of Justice.

In that letter, Mnuchin also questioned the scope of Congress’s investigative authority and Neal’s stated reason for the request -- that he wants them to insure that the IRS is properly auditing presidents.

“I am aware that concerns have been raised regarding my request and the authority of the Committee,” Neal wrote. “Those concerns lack merit.”

There is “no valid basis” to question the legitimacy of the Ways and Means Committee’s legislative purpose, Neal added.

Federal law gives the chairmen of House Ways and Means, Senate Finance Committee and the Joint Committee on Taxation the power to request the returns of any taxpayer, although some legal scholars believe the request needs a legitimate legislative purpose, which Democrats say they have met.

All U.S. Presidents, Vice Presidents and Presidential Candidates have provided their Tax Returns, such as:

President Barack Obama { Democratic 2009 - 20170) provided 16 Tax returns from 2000 to 2015.

Vice President Joe Biden (Democratic 2009 - 2017) provided 18 Tax returns from 1998 to 2015.

President Bill Clinton (Democratic 1993 - 2001) provided 8 Tax returns from 1992 to 1999.

President Jimmy Carter (Democratic 1977 to 1981) provided 3 Tax returns from 1977 to 1979.

President Ronald Reagan (Republic 1981 - 1989) provided 6 Tax returns from 1981 to 1987.

President George H. W. Bush (1989 - 1993) provided 3 Tax returns from 1989 to 1991.

President Gerald Ford (Republic 1974 - 1977) provided 1 ax return of 1966.

President Richard Nixon (Republic 1969 - 1974) provided 4 Tax returns from 1969 to 1972.

President Harry S. Truman (Democratic 1945 - 1953) provided 36 Tax returns from 1935 to 1972.

President Franklin Roosevelt (Democratic 1933 - 1945) provide 25 Tax returns from 1913 to 1937.

Hillary Clinton (Democratic Presidential Candidate 2016) provided 16 Tax returns from 2000 to 2015.

President Donald Trump (Republic 2017 to present) provide 1 Tax return of year 2005.

Vice President Mike Pence (Republic 2017 to present) provided 10 Tax returns from 2006 to 2015.

President Donald Trump elected in November 2016 and has started his presidency since 2017 to present, but he submitted only his Tax returns of year 2005. What is the reason of hide?

Read this news from Bloomberg on Yahoo News at:

President Donald Trump elected in November 2016 and has started his presidency since 2017 to present, but he submitted only his Tax returns of year 2005. What is the reason of hide?

Read this news from Bloomberg on Yahoo News at:

VietPress USA News

www.vietpressusa.us

oOo

Democrat Sets April 23 Deadline For IRS to Deliver Trump's Taxes

(Bloomberg) -- Citing an “unambiguous legal obligation,” House Ways and Means Committee Chairman Richard Neal set the IRS an April 23 deadline to hand over President Donald Trump’s tax returns before potentially resorting to other legal options.

Neal, a Massachusetts Democrat, sent a second letter to the Internal Revenue Service on Saturday, asking for six years of Trump’s personal and business returns, citing a section of the tax code that allows the chairman of the tax committees to request the returns of any taxpayer, including the president.

“Please know that, if you fail to comply, your failure will be interpreted as a denial of my request,” Neal wrote.

Neal sent a letter earlier this month to IRS Commissioner Charles Rettig asking that the returns be turned over by April 10. Treasury Secretary Steven Mnuchin responded by the deadline saying he needed more time to review the request and consult with the Department of Justice.

In that letter, Mnuchin also questioned the scope of Congress’s investigative authority and Neal’s stated reason for the request -- that he wants them to insure that the IRS is properly auditing presidents.

“I am aware that concerns have been raised regarding my request and the authority of the Committee,” Neal wrote. “Those concerns lack merit.”

There is “no valid basis” to question the legitimacy of the Ways and Means Committee’s legislative purpose, Neal added.

Law on Side?

Federal law gives the chairmen of House Ways and Means, Senate Finance Committee and the Joint Committee on Taxation the power to request the returns of any taxpayer, although some legal scholars believe the request needs a legitimate legislative purpose, which Democrats say they have met.

Members of the Trump administration, including acting White House Chief of Staff Mick Mulvaney, and their allies have called the request a political attack and a violation of Trump’s privacy.

The House Democrats’ asked that the returns be turned over to the members of Congress. They would then decide whether to release them publicly, but the political pressure among Democrats to do so would be high, as would the resistance among Republicans.

Under Audit

Trump broke with 40 years of presidential campaign tradition by declining to release his personal returns before the 2016 election. He said that he was under audit and didn’t intend to turn anything over until that process had been completed. There is no prohibition on releasing returns to Congress or the public while under audit.

“It pisses the members off if you don’t give them information that they think they should have. But for lawmakers, there’s no real effective remedy except to say bad things about them or not take their phone calls,” said Christopher Rizek, a former Treasury official who is now a tax litigator at law firm Caplin & Drysdale. “People expect the rule of law to work smoothly, but that”s not always the case.”

To contact the reporter on this story: Laura Davison in Washington at ldavison4@bloomberg.net

To contact the editors responsible for this story: Wendy Benjaminson at wbenjaminson@bloomberg.net, Ros Krasny

For more articles like this, please visit us at bloomberg.com

ooo

Hạnh Dương

www.Vietpressusa.us